Colors are sometimes used to indicate price movement, with green or white used for periods of rising prices and red or black for a period during which prices declined. So, a trader anticipating price movement could short or long one of the currencies in a pair and take advantage of the movement. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized.

USD JPY saw a lively start at the Tokyo open USDCNH breaks out – FOREX.com

USD JPY saw a lively start at the Tokyo open USDCNH breaks out.

Posted: Fri, 08 Sep 2023 01:45:49 GMT [source]

More liquid markets (such as the EUR/USD) will have narrower spreads than less liquid markets. The spread the trader pays the broker is more than the spread the broker will, in turn, pay when placing the trade. Forex trading is the exchange (or trading) of currencies on the foreign exchange market. Trading occurs in currency pairs such as the EUR/USD (the euro versus the U.S. dollar) and the USD/CAD (the U.S. dollar versus the Canadian dollar). The foreign exchange market is the most actively traded market in the world. Most online forex brokerages provide trade executions without charging trade commissions.

Developing a Trading Strategy

The only real difference is experience – banks employ experienced traders to trade the market and make them a profit. The good news is that experience is something that anyone can gain, provided you spend enough time on your trading platform learning about the market. The Forex market is an excellent choice but highly misunderstood amid an ongoing wave of misleading marketing campaigns. The low capital requirements and high leverage make it accessible to all, adding to its appeal.

- FP Markets is regulated by the Australian Securities and Investment Commission (ASIC).

- While Forex trading provides many opportunities, it also carries significant risks, as the retail market is almost entirely closed over weekends.

- Just like stock traders, Forex traders try to buy a currency cheap and sell it later at a higher price.

- It is important to find a strategy that suits your trading style and risk tolerance.

- Forex trading offers great opportunities for individuals to profit from the fluctuations in currency prices.

- Many international companies use the Forex market to hedge their currency exposure and even to lock in future exchange rates to gain clarity over operating expenses.

The FX market is the only truly continuous and nonstop trading market in the world. In the past, the forex market was dominated by institutional firms and large banks, which acted on behalf of clients. But it has become more retail-oriented in recent years—traders and investors of all sizes participate in it.

Best Forex Brokers in USA

Since London remains the most liquid global financial center, numerous Forex trading for beginners UK editions emphasize its unique Forex trading infrastructure. Understanding what moves Forex markets is essential to the success of Forex traders. Therefore, traders must consider developments in both, as either one can move price forex trade for dummies action. The three primary Forex market movers are economic data, central bank policy, and geopolitics. Since economic reports follow a set schedule, in-depth calendars give Forex traders sufficient visibility. Some traders attempt to profit from the often-volatile period before and after a release, known as news trading.

- Most successful Forex traders are self-taught, which is the best way to learn how to trade.

- Therefore, trading from a competitive jurisdiction can offer traders an edge, with the EU the least competitive one.

- These are also the market hours when the market is the most liquid, meaning that transaction costs will usually also be lower than when trading outside the NY-London overlap.

- Margin is less of a transaction cost and more a security deposit which the broker holds while a forex trade is open.

Leverage is basically borrowed capital used to increase the potential returns. The Forex leverage size usually exceeds the invested capital for multiple times. A wide selection of economic data can shake the direction of currency pairings. Inflation, GDP, employment, retail sales, trade balances and purchasing managers’ index are major drivers of market prices. When searching for the price of a forex pair a trader will see two prices. These are the bid price, the price at which a trader can sell a forex pair, and the ask price, which is the price at which a trader can buy a currency pair.

FP Markets

“You can easily trade using leverage which means that you need relatively little capital to be able to trade forex,” says Julius de Kempenaer, senior technical analyst at StockCharts.com. It’s estimated that the retail Forex industry accounts for around 5% of the total daily turnover of the market, i.e., for around $250 billion. However, the Forex market is big enough that no single market participant can notably influence exchange rate moves, not even big banks with their multi-million orders. This levels the playground a little bit and provides fair market pricing to all participants. A futures contract is a standardized agreement between two parties to take delivery of a currency at a future date and a predetermined price.

Focus instead on reading honest explanations and debates from real traders who admit to losing streaks, because this will be genuine advice and not marketing. BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following.

How do Currency Markets Work?

Learning how to trade Forex will separate those who succeed and grow their portfolios to support their lifestyle from those who skip the educational section and rush into placing trades. The Bid/Ask Price is the price at which a market-maker or dealer buys securities or other assets. Once you have set up your trading account, you can start by familiarizing yourself with the trading platform and its features. Most platforms offer demo accounts, which allow you to practice trading with virtual money. This is a great way to learn the basics and test your trading strategies without risking real capital.

Asian Currency Authorities Aim to Halt Declines Against … – Investopedia

Asian Currency Authorities Aim to Halt Declines Against ….

Posted: Wed, 06 Sep 2023 19:29:44 GMT [source]

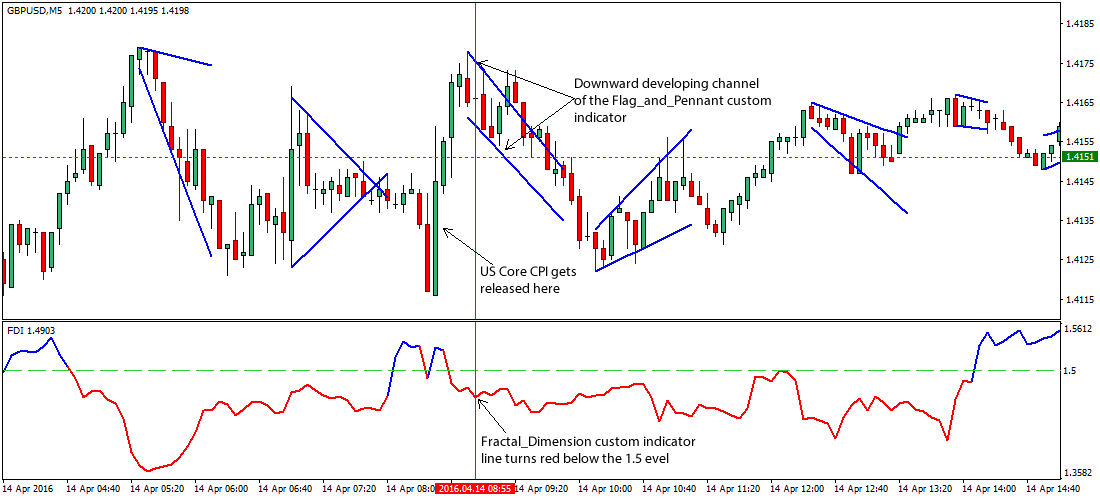

Fundamental analysis is usually longer term based compared to technical analysis, as it takes a certain period of time for the fundamental forces to change exchange rates and create a trend. For traders—especially those with limited funds—day trading or swing trading in small amounts is easier in the forex market than in other markets. For those with longer-term horizons https://g-markets.net/ and more funds, long-term fundamentals-based trading or a carry trade can be profitable. A focus on understanding the macroeconomic fundamentals that drive currency values, as well as experience with technical analysis, may help new forex traders become more profitable. One of the most essential, repetitive, and demanding tasks of Forex trading is Forex market analysis.

Like other instances in which they are used, bar charts provide more price information than line charts. Each bar chart represents one day of trading and contains the opening price, highest price, lowest price, and closing price (OHLC) for a trade. A dash on the left represents the day’s opening price, and a similar one on the right represents the closing price.

The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners. When you are trading with borrowed money, your forex broker has a say in how much risk you take. As such, your broker can buy or sell at their discretion, which can affect you negatively.

Comments are closed.